The return on investment in battery storage Understanding the Key Aspects of Investing in Battery Storage Solutions: It is a crucial question for many investors and stakeholders interested in sustainable energy solutions. In this article, we will explore what you need to know about investing in battery storage, how the market is evolving, what return on investment assumptions are, and what factors influence the success of such investments.

Battery Energy Storage Systems (BESS) allow for storing electrical energy for later use. This technology plays a crucial role in the transition to renewable energy sources as it helps to balance the differences between electricity production and consumption. Consequently, it increases the efficiency and reliability of the entire energy system.

Economics of Battery Storage Systems

Investing in BESS is primarily motivated by the need for grid stabilization and increasing the share of renewable energy sources. The return on such investments depends on several factors:

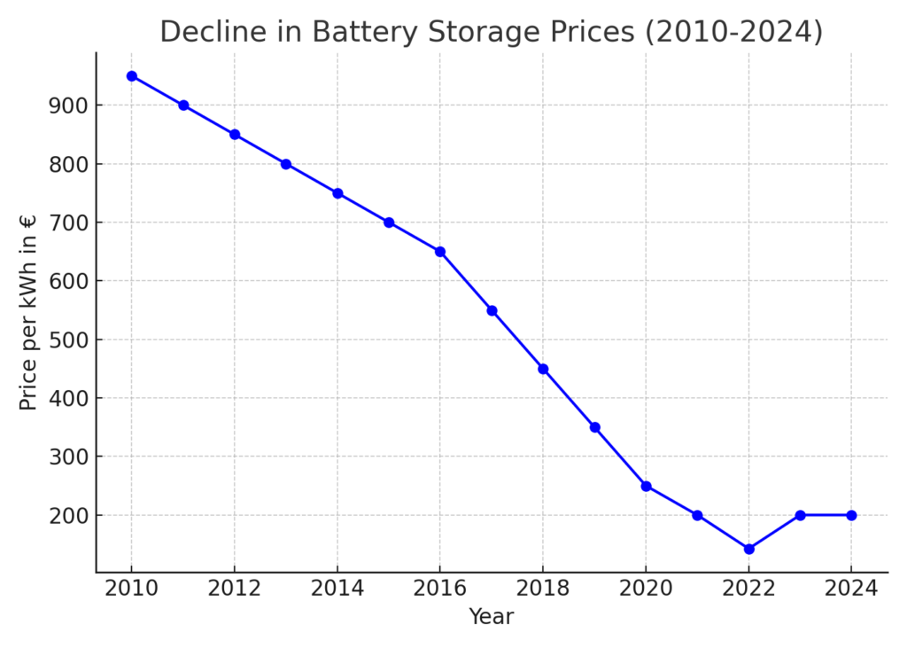

- Technology Cost: Costs of battery systems are decreasing due to technological advancements and increased production capacities.

- Regulatory Environment: Supportive regulatory frameworks and incentives can enhance the attractiveness of investments.

- Electricity Prices: The profitability of BESS also depends on differences in electricity prices at different times, enabling so-called time arbitrage.

- Operating Costs: Lower operating and maintenance costs can increase the net present value (NPV) of the project.

Key Success Factors

- Technological Selection: A crucial decision is the selection of battery type, which depends on the required performance, capacity, lifespan, and environment.

- Utilization Optimization: Maximizing the efficiency of storage utilization enhances its economic viability.

- Flexible Market Models: Access to flexible market models and the ability to respond to market signals are key to ensuring profitability.

Return on Investment Assumptions

Electricity Price Growth: Expected growth in electricity prices can increase the potential for time arbitrage..

Long-Term Horizon: Investments in BESS are typically advantageous with a longer investment horizon.

Subsidies and Incentives: Various forms of support exist in many jurisdictions that can significantly impact financial returns.

Decline in prices of battery storage systems (2010-2024)

Future Development and Trends

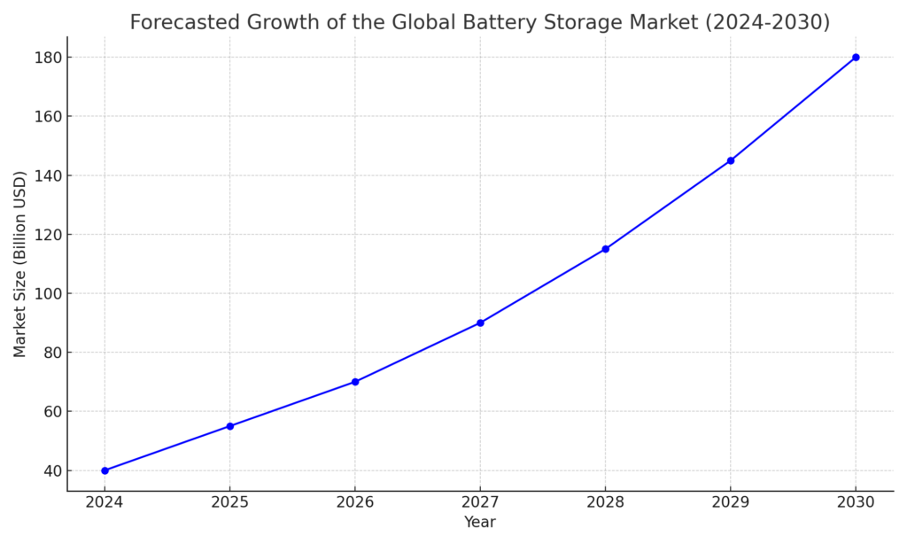

The BESS market is expected to continue growing, driven by ongoing price declines, regulatory changes, and increasing demand for renewable energy sources. Heightened interest in sustainability and energy decarbonization also contributes to the expansion of the battery storage market. This trend is further supported by technological innovations that improve the performance, capacity, and lifespan of batteries, opening up new possibilities for their utilization.

Innovations and Technological Development

The development of new materials and technologies, such as solid electrolytes and advanced lithium-ion batteries, promises higher safety, longer lifespan, and better energy density. These innovations can further reduce costs and increase the attractiveness of investments in battery storage.

Regulatory Development

The regulatory environment is evolving to support the integration of BESS into energy systems. This includes, for example, simplifying the grid connection process, introducing mechanisms to reward storage for grid services, or increasing transparency in energy markets.

Economic and Market Factors

The dynamics of the energy market, such as fluctuations in electricity prices and increasing demand for flexible services, create opportunities for battery storage. The ability to quickly respond to these changes can enable battery storage to capitalize on market opportunities, thereby increasing their economic value.

Challenges and Risks

Investments in BESS are also associated with certain challenges and risks. Among the main challenges is the speed of technological advancement, which can devalue current investments, and the need for an appropriate regulatory framework that would ensure fair market conditions for all participants.

In conclusion

The return on investment in battery storage depends on many factors, including technological, economic, and regulatory aspects. While there are challenges and risks, ongoing price declines, technological innovations, and positive regulatory developments indicate promising potential for future investments. Investors should pay attention to these trends and adapt their strategies to maximize returns and contribute to a more sustainable energy future.

Predicted growth of the global battery storage market (2024-2030)